The Future of Rail Power – The drive for hydrogen and battery-powered trains in the UK

To meet the UK Government’s target of net zero carbon by 2050, the rail industry has been set the challenge of replacing all diesel-only trains by 2040 (29% of the current fleet). In addition to extending electrification, the industry’s ‘decarbonisation taskforce’ has recommended the use of hydrogen and battery-powered trains to achieve the Lowest Lifecycle Cost (LCC). But what challenges and risks will these technologies bring to the rail sector?

In Japan, battery-powered railcars have been operating since 2014

RAISING STANDARDS

A number of companies, including train manufacturers, Rolling Stock Companies (ROSCOs) and operators, are leading the way in rail related hydrogen and battery R&D, including a depot-based hydrogen production and fuelling facility. There is clearly the appetite to pursue these options, but currently there are no specific rail standards for the design, installation and operation of the necessary infrastructure for energy storage, refuelling or charging systems. Such standards will be required to safely manage new systems, as well as to standardise their introduction for the optimal operation of the railway.

SAFETY ISSUES

The hazards associated with hydrogen are well understood: notably its propensity for producing flammable, explosive mixtures, acting as a chemical asphyxiate and leading to embrittlement of high carbon metal alloys. Unlike some applications, having hydrogen on board trains as a fuel source means that the rail industry cannot simply mitigate these hazards by segregation from the general public. Furthermore, the amplifying effects of this fuel source on the consequences of train collisions and derailments will also need to be taken into account.

High energy density batteries present their own hazards. High voltage components and cabling are capable of delivering a fatal electric shock, with some components able to retain a dangerous voltage even when a vehicle is switched off. In addition, the storage of electrical energy has potential to cause an explosion or fire, or release explosive gases and harmful liquids if batteries are damaged or incorrectly modified. Management of these hazards should be driven by cross-learning from the automotive industry, with fleets already in operation, as well as international rail efforts.

GOING GREEN

With the ultimate aim of cutting carbon emissions, it is vital that the environmental impact of these alternatives is well understood and minimised. Clearly, the hydrogen supply should not rely on heavy production of non-sustainable, greenhouse gas emitting ‘blue hydrogen’ when alternative ‘green hydrogen’ is available. In Germany, train companies are proposing to use ‘grey hydrogen’, which is a by-product of industrial chemical processing and might be considered in the UK as a transitional measure.

For batteries, environmental concerns tend to focus on the decommissioning of components and the associated hazardous waste products. The battery industry is beginning to address this issue with manufacturer Northvolt, for example, beginning a new programme ‘Revolt’ devoted to the recycling of lithium batteries. The decommissioning of batteries should be considered upfront as an integral part of the industry’s strategy.

Given the age of the UK’s rail network and the staggered manner in which it developed, there are many variations in design across the network. The difference in electrification systems, employing overhead lines and third rail, will directly affect battery charging options, particularly if there is a requirement to be able to use the new rolling stock without route restrictions.

Additionally, there may be limitations on the distance that battery-powered trains can run, which would confine their use to specific routes, though with ever improving endurance this may not be a long-term issue. Nonetheless, recovery measures may need to be devised for stranded trains that lose charge under degraded or emergency conditions. Operations And Maintenance (O&M) will also be complicated by running mixed stock on one route.

SMART FUNDING

Funding has proved to be a big issue in Germany for providing discontinuous electrification to support charging of hybrid vehicles, with companies seeing little investment return. In order to make this transition successful in the UK, any funding scheme needs to take a holistic, long-term view, rather than influence decision-making by focusing on capital costs. Upfront investment will necessarily have to balance the competing requirements of ongoing R&D, new infrastructure (e.g. charging points and hydrogen refuelling) and ROSCOs (new rolling stock with battery or hydrogen powertrains). However, this can be offset against substantial savings, both capital and maintenance-related, associated with eliminating full line electrification. Getting such an integrated approach accepted, approved, and implemented will clearly be key for successful implementation.

LEARNING FROM EXPERIENCE

Prototype hydrogen trains have been operating in Germany for about two years, with filling directly from trailers while a fixed supply station is built. The trial has gone well with no serious incidents and two fleets have been ordered in Niedersachsen and Hessen. In both cases, the rolling stock suppliers are responsible for maintenance and, together with partners from the gas industry, the hydrogen supply. To realise an acceptable LCC, long-term contracts were placed (25+ years). The roll-out of Battery Electric Multiple Units (BEMUs) – battery electric railcars – is picking up speed, and quickly. Japan and Austria have been operating battery powered trains since 2014 and 2019, respectively. Three fleets have also been sold in Germany, but are not yet operational. Analysis shows that if the franchise and network is matching to the needs of the technology – including planning, geometry, distance, scheduling, and availability of electrification – this approach is more attractive than hydrogen. A number of infrastructure management issues have been encountered relating to finance and regulatory aspects, which should not be underestimated in the UK’s implementation strategy.

CONCLUSION

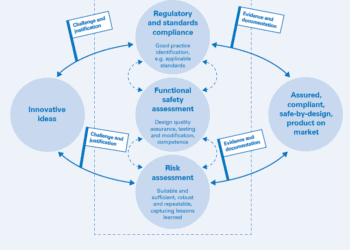

To achieve net zero carbon by 2050, the UK rail industry has committed to the removal of diesel trains by 2040. Analysis shows that battery and hydrogen trains are viable options in areas where full electrification is not warranted. A key enabler is to ensure that a long term, integrated systems approach is taken when assessing available options. As such, this should consider safety, reliability and environmental impact, as well as capital and ongoing costs across all railway systems (rolling stock, infrastructure and operations and maintenance).