Societal risk criteria – when is too big too often?

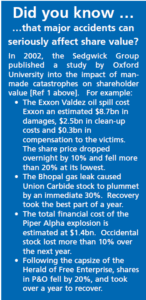

All fatal accidents are a cause for regret, but society generally tends to be more concerned about multiple fatalities in a single event. While such low-frequency high-consequence events might represent a very small risk to an individual, they may be seen as unacceptable when a large number of people are exposed. Such incidents can significantly impact shareholder value and, in some cases, the company never recovers [Ref 1].

Where the people exposed are members of the public, the term societal risk is often used. Where workers are isolated and members of the public are unlikely to be affected, the term group risk is often used. Here, the term societal risk is used to encompass both public and worker risk.

Criteria may be defined to limit the risk of major accidents and help target risk reduction measures such as restrictions on concurrent activities or land use, enhanced engineered safeguards, and improved building siting or protection. But what should these criteria be?

FN-Criteria

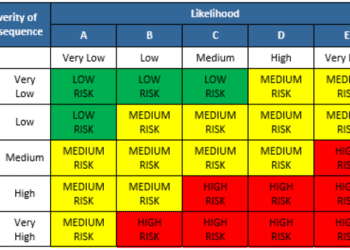

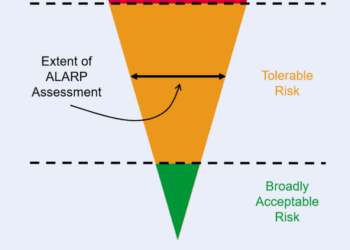

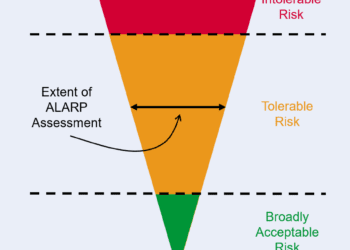

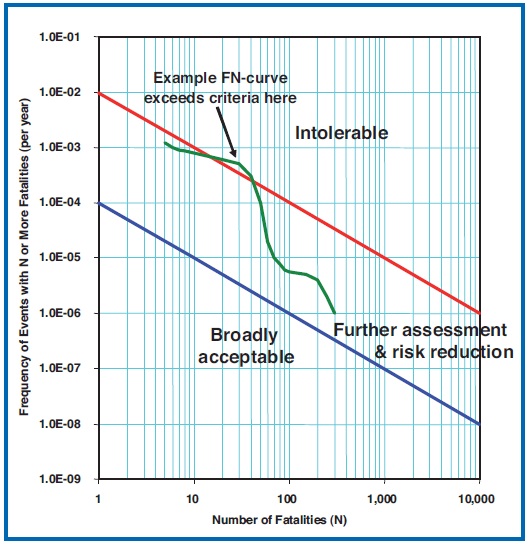

A common form of risk tolerability criteria for societal risk is the FN-diagram, where two criteria lines divide the space into three regions – where risk is intolerable, where it is broadly acceptable and where it requires further assessment and risk reduction as far as is reasonably practicable, as shown in Fig 1.

Figure 1 – Illustrative FN-Criteria

FN-criteria are not without their drawbacks but they are undoubtedly helpful when used in context. They clearly show the relationship between frequency and size of accident. A steep criterion slope also builds in multiple fatality aversion and favours design concepts with lower potential for large fatality events.

Industry criteria

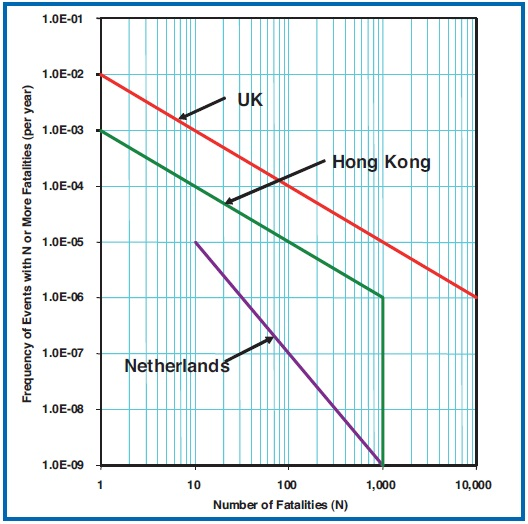

Unfortunately, there are no single “one-size-fits- all” criteria for societal risks in use by operators and regulators in the major hazard industries world-wide. Indeed, the variation in regulatory criteria is especially wide, as shown by the upper tolerability criterion lines in Fig 2, which span a factor of over 100. The Dutch criterion is so restrictive that it raises a question about its merits.

Figure 2 – Regulatory FN-Criteria

For a company operating in regions where there are no regulatory criteria to meet, the choice of criteria to help decision-making largely comes down to one of company values, i.e. the perceptions of the stakeholders directly affected by the decision and the values of the company in terms of its safety commitment and reputation.

Expressed from a dispassionate business perspective, the company needs to decide how frequently large-fatality accidents would need to occur before the company’s survival is put severely at risk due to the adverse reaction of shareholders, the regulator, media and public.

Current industry initiatives

Societal risk is currently very topical:

- The Center for Chemical Process Safety (CCPS) in the USA will, this year, develop a guideline book providing a framework for establishing quantitative safety risk tolerance criteria. The book will show how to develop criteria reflecting company-specific operating needs, while maintaining consistency with industry wide practices.

- The UK safety regulator has recently issued a consultative document on societal risk which builds on the current regulatory requirements.

Summary

A single accident at an industrial facility that causes multiple fatalities can seriously threaten the future of the operating company. Criteria can help to identify where risk reduction measures need to be targeted to limit the societal risk to a level that the company is comfortable with. In the absence of regulatory criteria, the choice of risk level largely comes down to one of the company’s values.

But whatever criteria are selected, they need to be workable in practice – if they are too severe or too relaxed they will lose their usefulness – and should be based on a sound assessment of current good practice in industry.

Ref 1 – The impact of catastrophies on shareholder value, Sedgewick Group, 2002.

This article first appeared in RISKworld Issue 11.