Investing in Safety – The hidden savings of accident prevention

There are many hidden, unrecoverable costs associated with an accident that are much greater in magnitude than most people realise. Looked at another way, there are substantial, unseen savings built-in to accident prevention activities. But what are these hidden costs (savings) and can they be calculated?

INTRODUCTION

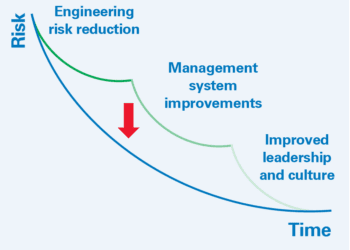

Consider these three statements: commercial ventures exist to make money; accidents cost money; effective safety management reduces the likelihood of accidents. If you agree with all three, then it should be self-evident that investing in safety makes financial sense. Indeed, in a proactive health and safety culture, safety management is seen as a net money maker – or even a critical element for increasing profitability – so weighing profit against the cost of safety is actually a non-issue.

Understandably, however, some organisations may require an explicit demonstration that accidents are more expensive than their prevention, before committing to investment. That means quantifying expenditure on preventing accidents, and making a comparison with the savings generated by fewer accidents in the future. Unfortunately, calculating savings is easier said than done.

ACCIDENTS COST MORE THAN YOU THINK

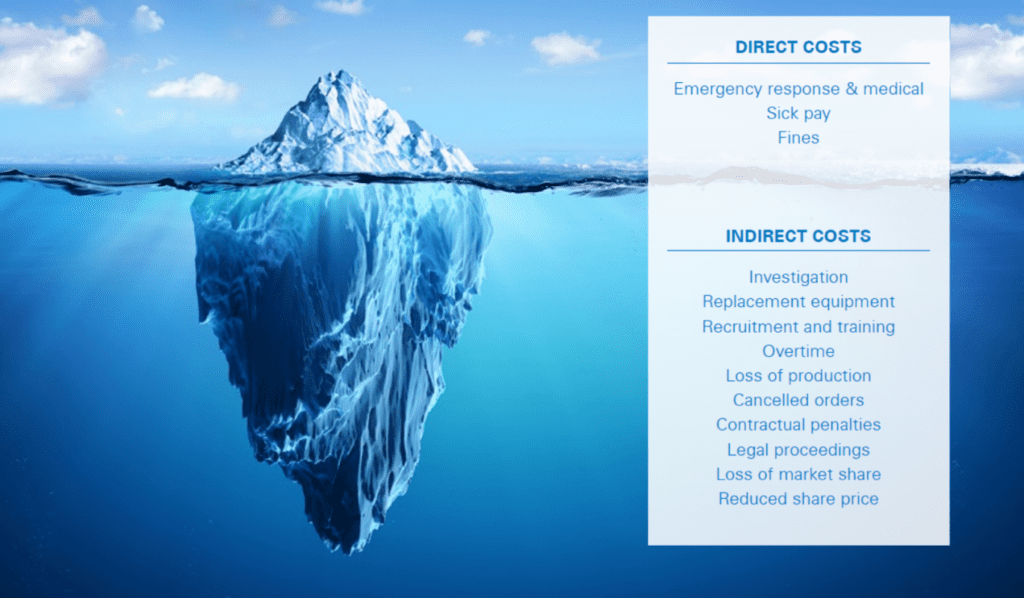

All accidents, whether minor occupational incidents or major accidents, cost money. It is normally straightforward to identify and quantify direct costs, such as emergency response expenses and regulatory fines. But there are often indirect costs which are hidden, less well understood, and seldom easy to quantify.

For example, it may be a simple calculation to work out the direct cost of wages that still need to be paid when an injured employee is off work for a week, but that is just the tip of the iceberg. It is much more challenging to estimate the indirect costs of redistribution of the injured party’s workload, the selection and training of a replacement, or even the effects of reduced morale amongst the workforce.

The indirect costs of an accident are typically several times larger than the direct costs; estimates in the literature generally range from 5 to 50 times (Ref. 1). Furthermore, research highlights that the vast majority of accident costs are not covered by insurance, with uninsured costs between 8 and 36 times greater than insured costs (Ref. 2). So not only are the hidden, indirect costs by far the largest part of the total cost of an accident, they are also much more difficult to quantify, and mostly unrecoverable.

Viewed more positively, there are hidden savings in accident prevention, and these are much greater than you might think.

The iceberg metaphor – direct costs are only the tip of the iceberg

ACCIDENTS DESTROY PROFITABILITY

It can be worthwhile calculating the business impact of an incident in terms of the amount of revenue and profit that must be generated to pay for a single incident. The narrower a company’s profit margin, the more revenue that must be generated, or the longer the impact on profitability. For example, consider a lost time incident at an onshore drilling rig which usually makes a $10,000 profit each day. With direct accident costs of $200,000 and a (low) indirect cost multiplier of 5, the total cost to the business is $1.2 million, equivalent to 120 days of operation at zero profit!

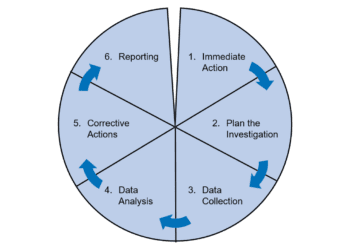

INVEST IN INVESTIGATION

Accident investigation is ingrained in good safety management practice, where the aim is to find out what happened and prevent recurrence, as well as satisfying corporate, regulatory and public expectations. However, accident investigations do not always assess the costs associated with the accident.

Studies into near misses consistently reveal a pattern: multiple near misses precede most disasters, and most near misses are ignored as cognitive biases conspire to blind managers, e.g. normalisation of deviance and outcome bias. One way of raising awareness of the true scale of the risk/opportunity offered by near misses is to assess the potential costs of these non-harm ‘incidents’, alongside the costs of actual accidents.

YOUR RISK, YOUR REWARD

Every incident and every business is different and hence, ideally, any cost impact estimate should relate specifically to the company and its place in the market so that it is representative. However, specific data are often not available, particularly if a similar event has not previously occurred. Where necessary, generic cost data published in research reports and by regulators provide a useful alternative, but they generally don’t offer much insight on indirect costs. When asked to calculate the costs of a real accident, assessors can produce huge variability in their estimates – over an order of magnitude. This illustrates the subjective nature of the assessment, and emphasises the need for a standardised cost calculation method underpinned by company-, industry and location-specific cost data. Online cost calculation tools (e.g. Ref. 3 and 4) provide templates which could be adapted for any organisation’s purposes.

COMMUNICATION IS KEY

It is common for assessors to encounter difficulties obtaining relevant information from departments within an organisation. Cost calculation is necessarily a team effort requiring input from multiple parties; effective communication between, and engagement with, those contributors is crucial. The time and effort involved in cost calculation, which can be considerable (and doesn’t necessarily scale with the severity of the incident), should also be accounted for in the overall cost of the incident.

CONCLUSION

It is only once the full financial impacts of accidents are understood that the wider value of proactive safety management can truly be understood and communicated in monetary terms. The precise quantification of accident costs can be problematic, but it is clear that such analyses overwhelmingly showcase that good safety programmes deliver a significant return on investment.

References:

1. “The Business Impact of Injuries and Incidents”, Warren Hubler, CSP Co-Chairman, O&G Extraction Council, H&P Int’l Drilling Co.

2. “The Costs of Accidents at Work”, HS(G)96, Second edition, HSE, 1997

3. Singapore Workplace Safety and Health Council – Incident Cost Calculator (available at www.wshc.sg)

4. Workers’ Compensation Board of British Columbia – Workplace Incident Cost Calculator (available at www.worksafebcmedia.com)