Risk management overkill: the hidden risk for major projects

There is an ancient Chinese saying “may you live in interesting times”. While purporting to be a blessing, this proverb was originally used as a curse. A high proportion of industrial, commercial and financial sectors across the globe would probably agree. For many, if not all, these times are much too “interesting”, not to mention challenging and uncertain, regardless of company reputation, track record or order book size. Now more than ever, with capped resources, limited funding and volatile markets, there is a growing emphasis on risk and financial management, particularly for major capital projects, at all stages of the project life cycle.

BALANCE OF RISK

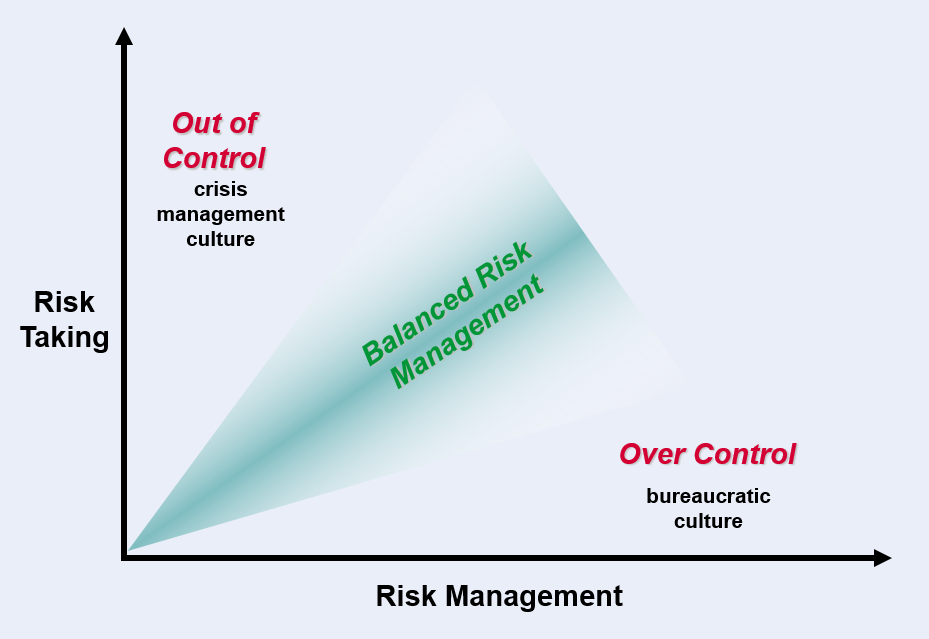

The balance between a willingness to take risks for business purposes and the degree of risk control imposed can strongly influence a project’s chances of success, as illustrated by Figure 1. Ideally, the degree of risk control should be proportional to the level of risk exposure. This may take the form of corporate governance, formal risk reviews, and defined project hold points or “tollgates”, for example.

Figure 1 – Risk Management Strategies

For major capital projects, where there are invariably a number of major parties involved, it can be challenging to agree on the appropriate level of risk control. This can be particularly difficult in times of rapid change or uncertainty, such as those we are experiencing today, where:

- The availability of project finance is severely constrained

- Design & construction costs are falling

- Supply chain businesses are failing

- Commodity prices are volatile

Each party involved in a project may have a different perspective on these areas of uncertainty.

BAD REACTION TO RISK

With this kind of uncertainty, there is a natural tendency to increase the level of risk control and introduce more risk-averse criteria. While this is understandable, there is the potential to overcompensate, which could threaten project viability or introduce unnecessary costs.

The discipline of project risk management is well understood and much has been written about the pitfalls of leaving risks unidentified and unmanaged. What is less well documented is the potential for overzealous risk management to suffocate or even terminate projects, a situation that can only be exacerbated in the current credit crisis.

A SENSE OF PROPORTION

To counter this, the aim should be to manage risks efficiently and effectively, for example by:

- Actively engaging with major project ‘players’

- Systematically identifying risks and assessing them

- Integrating practical risk management controls into day-to-day activities

- Focusing on tangible actions that actually reduce risk

- Imposing a level of scrutiny that is proportional to risk

While this may imply an overhaul of existing arrangements, the emphasis should be on value for money rather than paperwork.

This article first appeared in RISKworld Issue 15.