Digitalisation: The impact on risk management

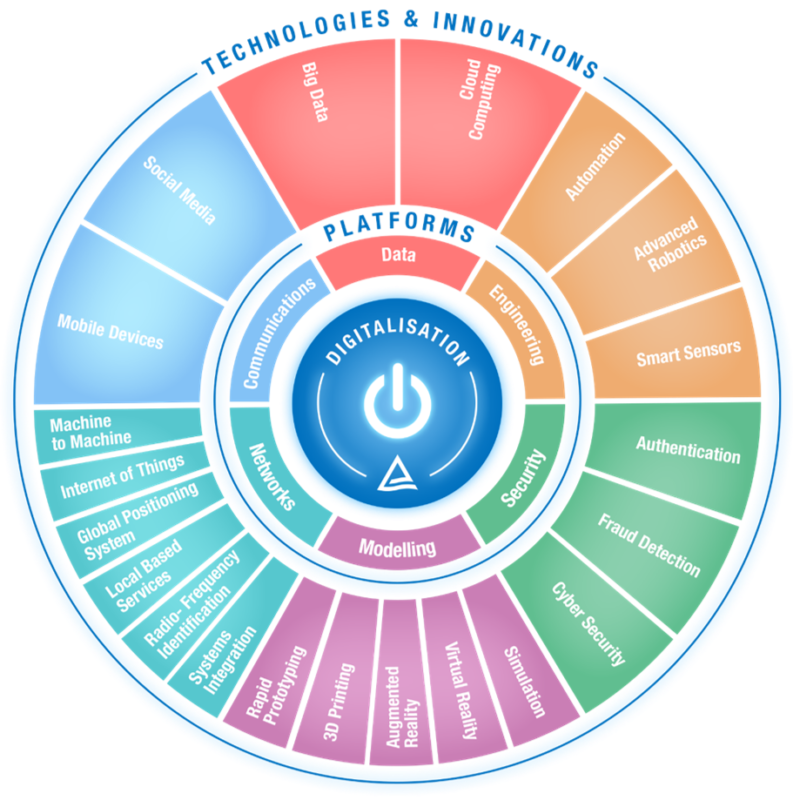

In a previous article we cut through buzzword phrases such as ‘The Second Machine Age’ and Industry Revision 4.0’ to explore what ‘Digitalisation’ is and what it means to high hazard industries. Whilst it’s very easy to be seduced by all the exciting engineering and technology that sits behind this innovation, it is crucial that we do not overlook the considerable impact it will have on how we manage risk.

THE LAW

The UK’s legislative risk management framework, which has shaped the practices of many major hazard organisations around the world, originated in 1949 through a court judgment (Ref. 1) which enshrined in law the concept of reasonable practicality, and later became the principle of ALARP (As Low as Reasonably Practicable). This has formed the basis of how safety risk has been managed ever since. As a thought experiment, it is interesting to ask how something born out of the mining industry, where workers braved arduous conditions to extract coal manually with basic tools, remains relevant and appropriate within a digitised world featuring robots and autonomous vehicles, all powered by artificial intelligence (see Figure 1)? Similar questions can be asked of other regulatory regimes around the world.

NO DINOSAUR!

Make no mistake, established risk management frameworks are no dinosaurs. They have helped nurture, evolve, challenge and legislate huge advances in technology from nuclear power generation to worldwide passenger flight, to name just two. Yes, they’ve changed with the times, and need to keep evolving, but the fundamental principles and ethos remain the same. They’ve been a strong, stable and consistent guiding light in very changing times.

STEP CHANGE?

Perhaps Industry 4.0 will prove to be a series of small incremental steps not dissimilar to the evolution we’ve seen over the last few decades. It may all prove to be a fuss about nothing. However, there is sufficient informed opinion to suggest that it will create such a significant step change in what society looks like and how it functions that it is only right that we take a step back to consider the suitability of our existing risk management approaches.

THE IMPACT

So, what is the likely impact of digitalisation on how we manage risk?

Firstly, it will allow us to do entirely new things, realising entirely new risks. For example, consider collaborative robots (known as cobots), where humans and robots work together. If the cobot is controlled by Artificial Intelligence (AI) and handling hazardous tools or equipment, how do we assure the safety of its human co-worker? We must develop a detailed understanding of the associated risks and adapt or develop appropriate techniques to ensure we manage them effectively.

In the case of AI, which is characterised by the capacity to learn continually and make decisions, how do we identify what can go wrong and how can we prevent serious injury or at the very least minimise the associated risk?

Whilst this and similar challenges should not be underestimated, we have a strong track record of adapting to change over many decades. Perhaps of equal importance is managing society’s perceptions of these new risks.

Returning to AI safety, again, how safe does an autonomous vehicle have to be to gain public acceptance? At least as safe as a human driver, ten times safer, or one hundred times safer? Certainly, AI will not eliminate vehicle accidents altogether.

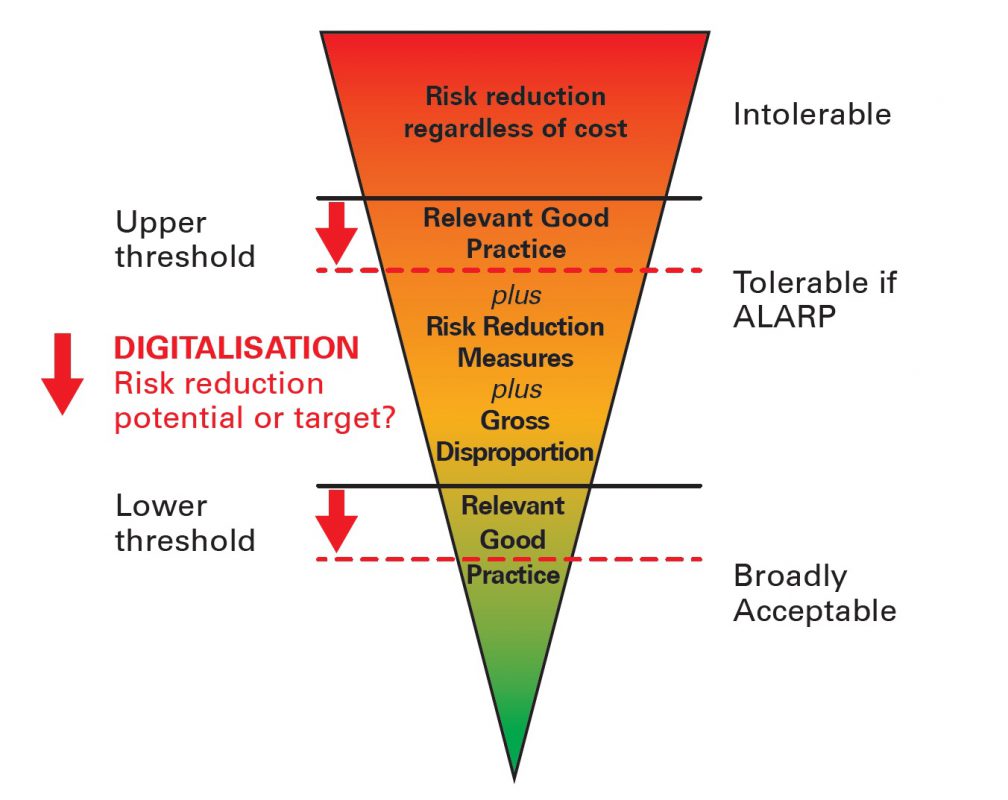

And if a step-wise improvement in safety is achieved across multiple industries, we might well expect regulators to set a more stringent standard on what constitutes tolerable risk across the board (see Figure 2).

Secondly, digitalisation will help us do things better – faster and cheaper. But what about safer? Surely we have a responsibility to channel some of this innovation towards reducing risk rather than just maximising business or commercial gain. For instance, big data analysis can be used to identify trends in equipment health and optimise maintenance for large, complex, highly instrumented facilities. Could it be used in real time to predict failures and suggest preventive actions to operators?

Automated inspection technology could identify defects or degradation at a fraction of current costs, improving both operational availability and safety.

Thirdly, digitalisation will allow us to do things that were previously considered unsafe. Visual Reality (VR) or Augmented Reality (AR) could be used to direct robotic avatars in undertaking inspection or repairs in otherwise hostile environments, such as nuclear reactor cores, oil pipelines or confined spaces. Such solutions, will no doubt bring new risks into play.

Fourthly, digitalisation will change our understanding of known risks. Most likely this will be in the direction of lower risk estimates, as more sophisticated techniques and big data analysis allow excessive conservatisms to be stripped away from simpler, cruder historical approaches. For example, a combination of cutting edge statistical analysis and millions of thermo-hydraulic computer runs might demonstrate that failure of passive heat removal systems for the next generation of nuclear reactors isn’t credible.

There is a risk here that the new found risk ‘budget’ gets snapped-up for commercial gain, e.g. in the last example, this might be the removal of any provision for a second line of defence against core melt. However, as now, these decisions will need to be weighed using the ALARP principle.

Lastly, digitalisation will provide a means to directly reduce risk in its own right, which might become essential if safety goals become more onerous, as postulated earlier. This could involve the widespread use of automation, AI, smart sensors, VR or AR, to name but a few emerging technologies. Fortunately, existing risk management frameworks already demand that new technologies are evaluated when taking all reasonably practicable measures to reduce risks (Ref. 2).

CONCLUSION

Digitalisation will likely transform our lives profoundly, both directly as technology influences our daily lives, and indirectly in contributing to a safer, more secure industrial landscape. There are clearly exciting times ahead for the safety profession in understanding new hazards and new technological controls as they emerge; and adapting and developing the techniques and tools needed to assess and manage the associated risks. Although the detail may change, the broad principles of our existing risk management frameworks are as relevant today as seventy years ago.

References:

1. UK court judgment in the case Edwards v. National Coal Board, 1949.

2. HSE – ALARP “at a glance” guidance – http://www.hse.gov.uk/risk/theory/alarpglance.htm.